how to pay taxes on betterment

For individuals only. Your heirs will pay taxes on withdrawals from.

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

The 1099-DIV reflects dividend payments received and capital gains distributions from stocks you own.

. You can pay your taxes online or by phone on the IRS own system. Most ETFs pay dividends which are reported on your Form 1099-DIV. Make a same day payment from your bank.

500 is in regular investment account. This is the only one that matters for tax purposes. While you cannot deduct betterment taxes from your income when you file your federal income.

15 2022 if you had a Betterment taxable account and. You pay yourself 60000 a year as a salary and pay the 153 self-employment tax of. Credit or debit cards.

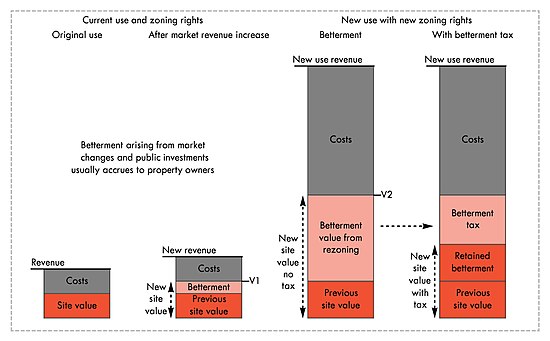

A Betterment is a Financial Agreement between a homeowner and the community. So how do you pay 0 taxes when you make six figures. Pay your taxes by debit or credit card online by phone or with a mobile device.

Schools roads parks hospitals and other public works and services rely on you and your neighbors businesses organizations and estates to pay taxes that will help fund their. You are being redirected. Pay your taxes by debit or.

Any dividends earned will be taxable. The Betterment Agreement outlines the rights and responsibilities of the community and the. These are generally taxable typically at your ordinary marginal tax rate 0-37 Federal.

Special Property Tax A. Pay directly from a checking or savings account for free. No matter the investment platform if you recognize gains receive dividends or earn investment income from investments youll still need to pay your share of taxes.

Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as rollovers in their retirement accounts on the. As an added bonus it can help you avoid paying income tax on Social Security benefits in retirement. View the amount you owe your payment plan details payment history and any scheduled or pending payments.

You will receive one by Feb. Any sales where you make money will be a taxable event.

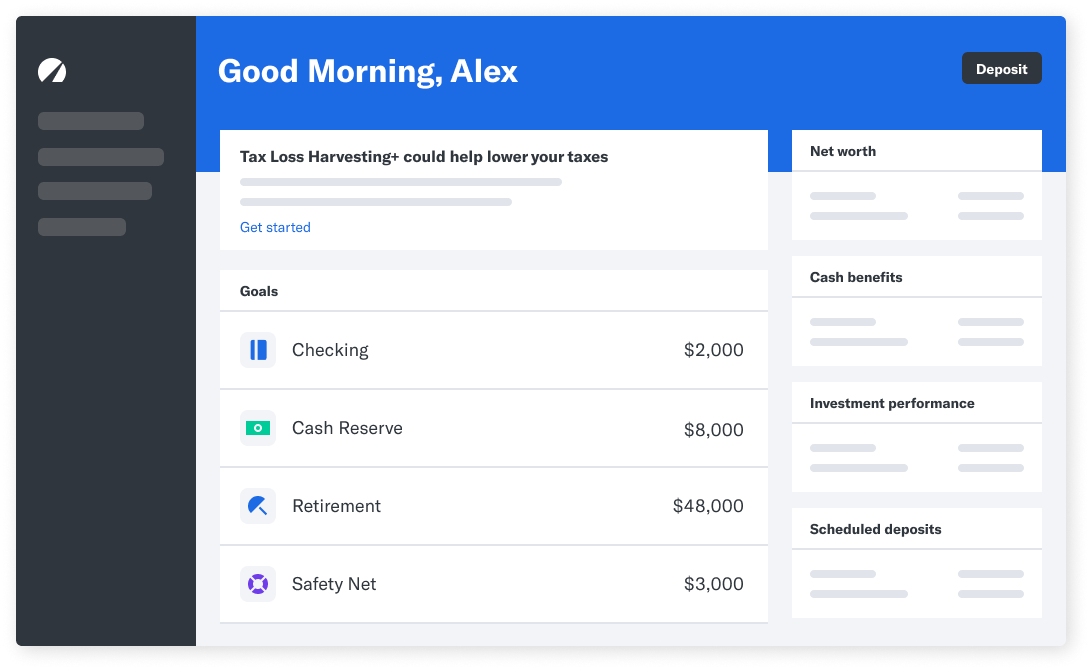

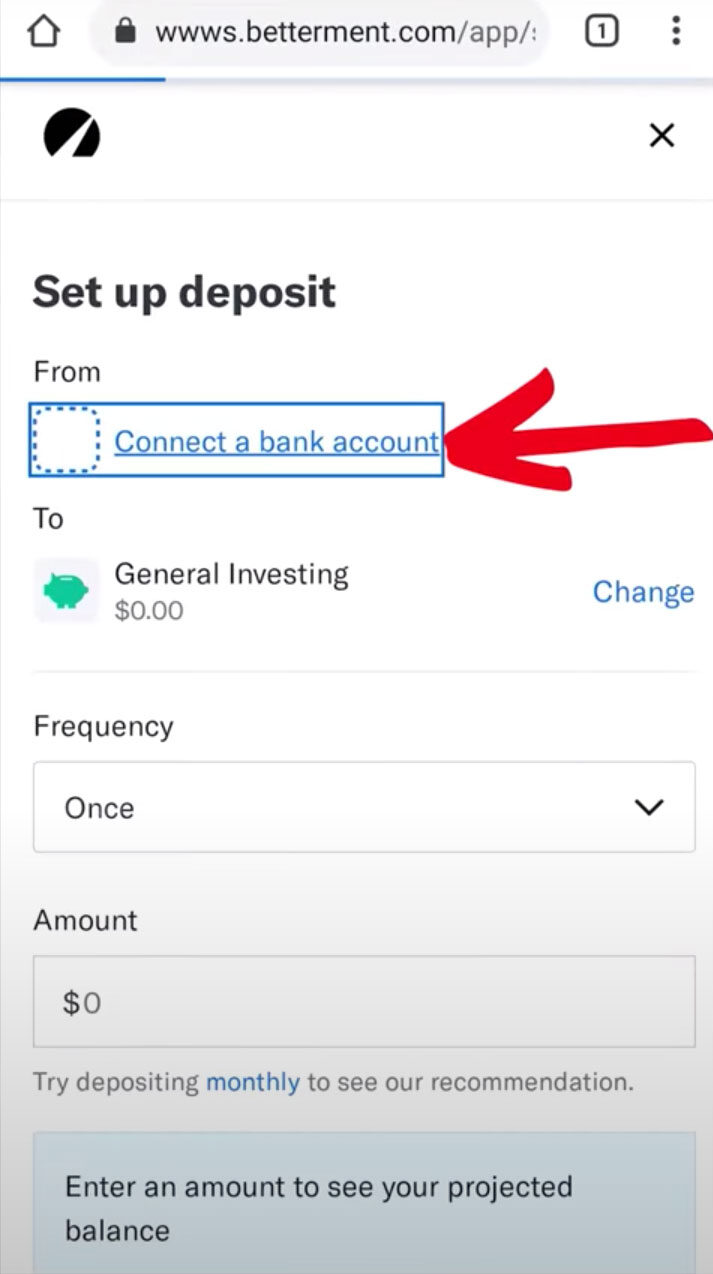

How To Open An Account With Betterment

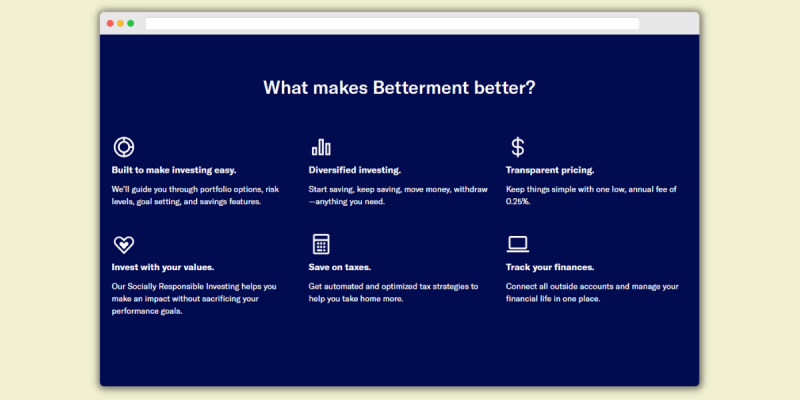

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Betterment Review How It Works Pros Cons

Betterment Review 2022 A Robo Advisor Worth Checking Out

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Betterment Review How It Works Pros Cons

Betterment Review Pros Cons And Who Should Set Up An Account

How Do Taxes Work For Investment Accounts

Betterment Review 2022 The College Investor

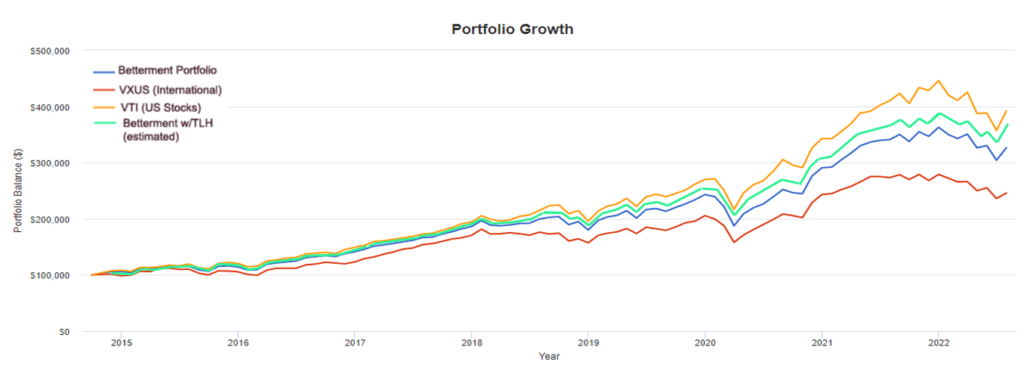

We Just Saved 42 000 By Not Switching To Betterment Early Retirement Now

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Are Betterment Returns Higher After Taxes Https Investormint Com Investing Betterment Returns Higher After Money Affirmations How To Get Money Money Goals

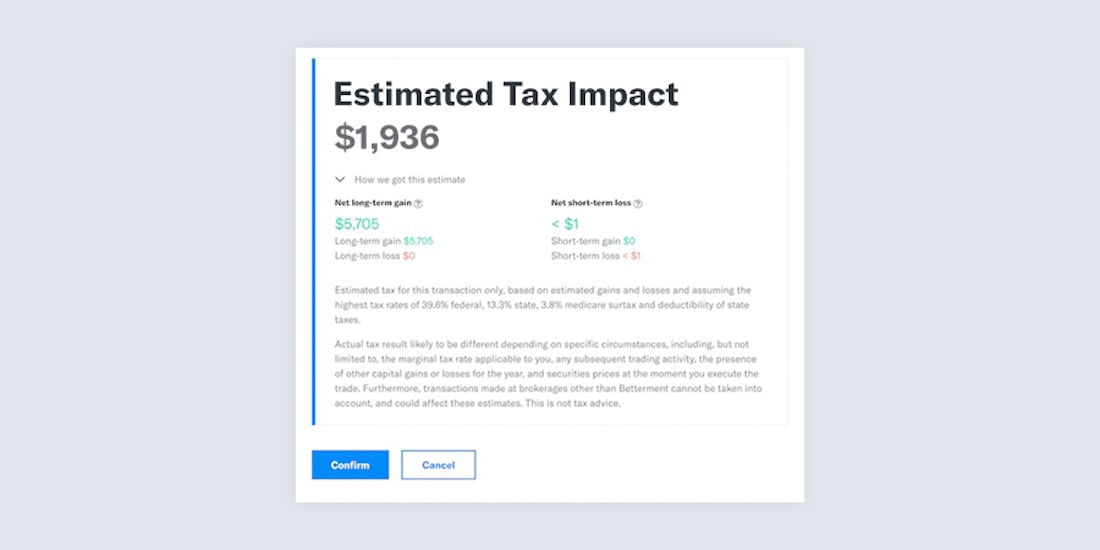

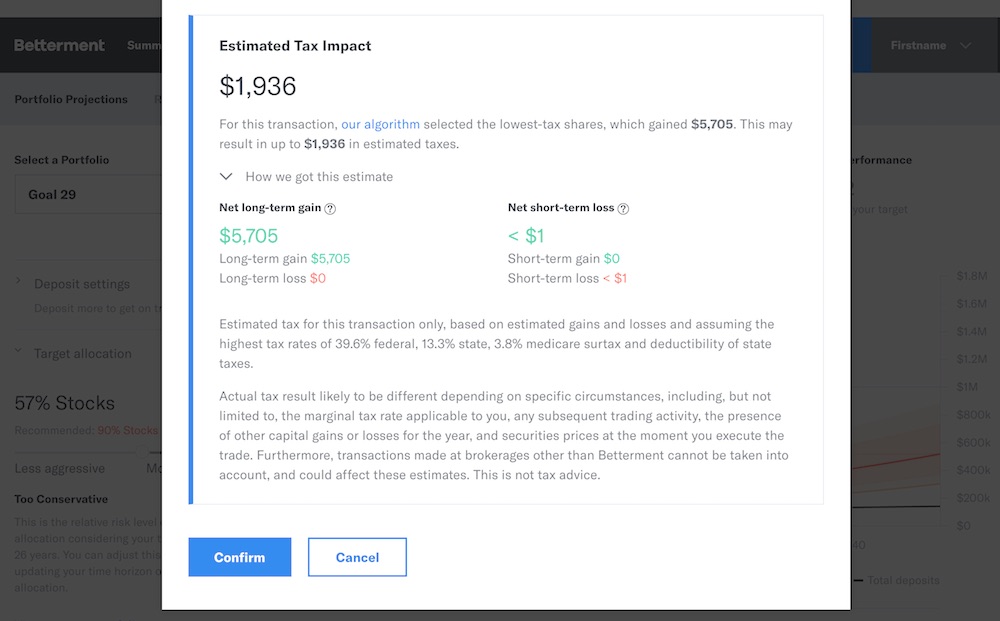

How Tax Impact Preview Works To Help Avoid Surprises

How To Plan Your Taxes When Investing

The Betterment Experiment Results Mr Money Mustache

Betterment Review Smartasset Com

How Tax Impact Preview Works To Help Avoid Surprises

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion